Mena startups raised $646 million in October 2022

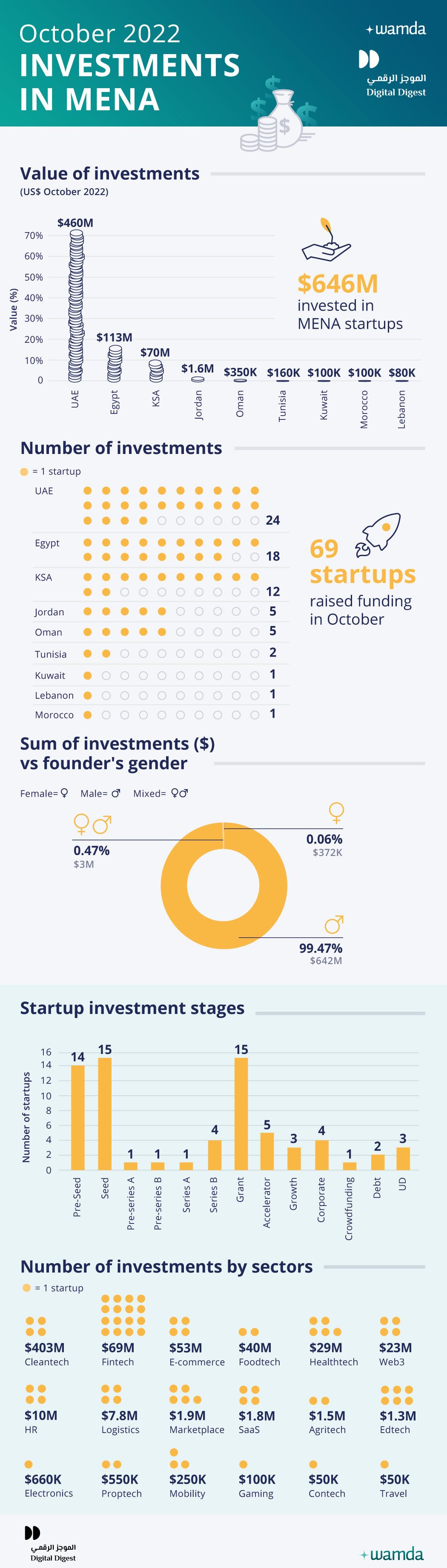

Startups in the Middle East and North Africa region (Mena), have raised $646 million across 69 deals, taking the total raised so far this year to $3 billion spread over 551 deals.

The cumulative deal value saw a 273 per cent increase from the $173 million raised in September, and a 331 per cent year-on-year (YoY) growth against $150 million raised in October 2021.

UAE stood on top fetching the majority of funding with $460 million raised across 24 deals. Cleantech Yellow Door Energy led the fundraise with a massive $400 million raise, one of the largest rounds ever recorded in the regional startup ecosystem.

Egypt came second with $113 million raised across 18 deals. The top three fundraisers included fintech MoneyFellows with its $31 million Series B round, open banking platform Telda with a $20 million Seed round and B2B marketplace MaxAB with $40 million for its pre-Series B.

Saudi Arabia, whose startups raised $70 million across 12 deals ranked third, with e-commerce enabler platform Zid grabbing the biggest chunk thanks to its $50 million Series B raise.

The uptick in October was largely attributed to a significant spike in late-stage financing. About 84 per cent of the capital inflow was driven by late stage startups including those at Series B and growth stages.

Meanwhile, Seed and pre-Seed startups showed a rather significant drop in activity, accounting for 7 per cent of capital raised. On a similar note, debt financing is becoming a more popular choice for startups raising at higher valuations. This was evident in the case of KarmSolar and Trella, both raising $2.4 million, $6 million respectively.

Sector-wise, the cleantech sector bagged the most thanks to Yellow Door Energy’s round. Fintech dominated the funding scene in terms of deal count attracting 16 deals out of 69 to the tune of $70 million, making it the second highest-funded sector in October. Neobanks and open banking startups were the most funded fintech segments.

Substantial amounts of funding were allocated to foodtech, generating 7 per cent of total funding activity, followed by e-commerce with 8 per cent and Web3 with 3.5 per cent. Business to business (B2B) SaaS startups raised $528 million across 36 deals, while business to consumer (B2C) startups raised $115 million across 30 deals.

Regionally, Egypt is home to the most active investors, participating in 18 deals, followed by their counterparts from the UAE with 15 and Saudi Arabia-based with 13.

Once again, international involvement showed subdued momentum. Only 18 out of 64 deals attracted foreign investors, with the US remaining a leading source of global funding poured into regional startups.

Last month witnessed a near absence of funding for female-led startups, which attracted 0.06 per cent of capital inflow. Startups with all-male founding teams accounted for 99.47 per cent of funding value, while startups with mixed teams pulled in 0.47 per cent.

Last month saw a rise in funds raised by regional investors. The list counts Egypt’s Nclude which secured commitments from MasterCard, Aliph Capital which raised $125 million from ADQ and STV which raised an additional $300 million from Saudi Telecom Company.

In October, ten startups did not disclose the exact amount they raised. They include Brexm, Cryptyd, Kiwe, Marah, Roboost, Santra, Ruba, Spotter, Takhlees, Unlock, and Wafii.