Mena startups raised $267 million in June 2021, pushing Q2 investment to $552 million

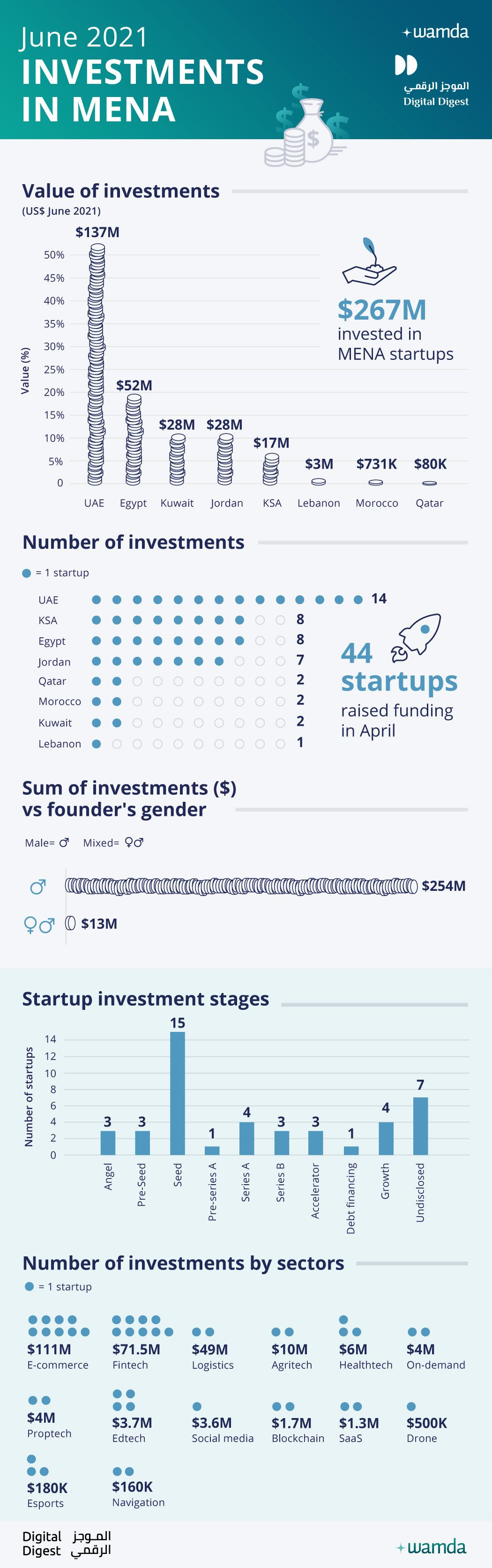

Startups in Mena have raised $267 million across 44 deals in June, propelling the second quarter investments to more than $552 million, a 33 per cent increase compared to the first quarter of 2021.

It was tabby’s $50 million debt financing round that pushed the UAE to the top spot in terms of investment value in June, which saw the country raise $137 million in total last month across 14 deals. The UAE’s eyewa ($21 million) and The Luxury Closet ($14 million) both closed a Series B round, while Opontia managed to raise $20 million in a Seed round for its e-commerce enablement platform.

Perhaps one of the most exciting investment deals in June was that of Egypt-based Trella, which attracted $42 million in a debt and equity round led by global shipping giant Maersk. Overall, eight Egyptian startups raised $52 million, ranking the country second in terms of number and value of deals.

Large rounds in the e-commerce sector including those from Floward ($27.5 million) and OpenSooq ($24 million) pushed total investments in the sector to $110.9 million across nine deals, while nine fintech startups raised $71.5 million. The logistics sector raised the third highest amount with $49 million thanks to Trella’s round.

Of the 44 investments in June, 37 went to male founded startups, and seven to mixed founding teams. Startups led by female founders received no funding.

In the first half of 2021, the 249 investment deals in Mena nearly broke the billion-dollar mark reaching $978 million, of which 44 per cent went to UAE startups, 27 per cent to Saudi Arabia and 12.5 per cent to Egypt.

It was the fintech sector that attracted the most investment with $306 million, of which $110 million alone was raised by Saudi Arabia-based buy now pay later startup Tamara in its Series A round. E-commerce did well once again with $181 million in investments, led primarily by the growth of B2B e-commerce players, and finally logistics startups raised $103 million, a reflection of the strength and growth of online shopping in the Middle East.

The top 10 biggest rounds in the first six months of 2021 were:

- Tamara: $110 million Series A

- Pure Harvest: $50 million raised via sukkuk

- Tabby: $50 million in debt financing

- Anghami: $40 million ahead of its SPAC

- Trella: $42 million in debt and equity

- Lyve $35 million in Series B

- Yellow Door Energy: $31.2 million debt financing

- Floward: $27.5 million Kuwait in Series B

- Starzplay $25 million in debt financing

- Sary: $20.5 million in Series B

Once again, startups founded by men dominated and attracted the vast bulk of investments with 96 per cent in the first six months of 2021, while female-founded startups attracted just 0.9 per cent.

These monthly reports are a collaboration between Wamda and Digital Digest. For startups that do not disclose the amount they have raised, we provide a conservative estimate for their rounds.