Mena startups raised $125 million in December, pushing 2022 total to $3.6 billion

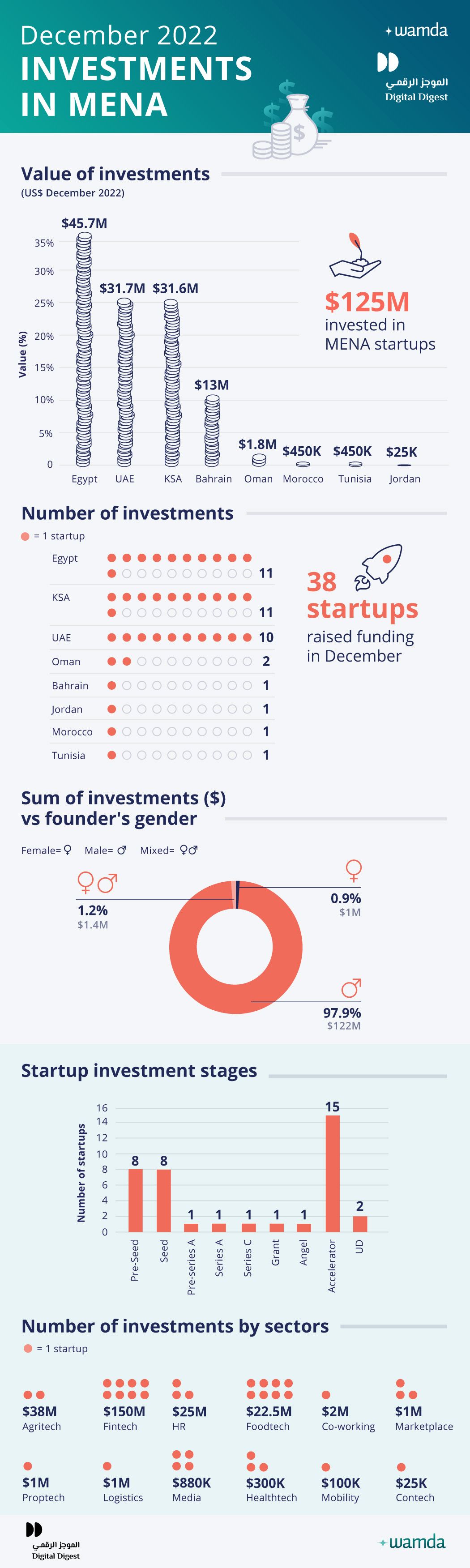

Startups in the Middle East and North Africa region (Mena) raised $125 million in December 2022 across 38 deals, taking the total amount raised last year to approximately $3.6 billion (a rise of 13 per cent compared to 2021) spread over 628 deals.

Funding in December was down 40 per cent compared to December 2021 and saw a 72 per cent decline on a month-on-month basis.

Egypt led the ranks with $45.7 million raised across 11 deals. The UAE and Saudi Arabia emerged second and third, having secured $31.8 million and $31.7 million respectively. In terms of deal count, Saudi Arabia and Egypt both claimed 11 each of the total while 10 UAE-based startups raised investment.

With fears of a global recession on the way, the knock-on effects have by and large triggered a worrying effect on the fundraising prospects of startups, particularly those at later stages of growth.

As has been the case with the past few months, late-stage venture activity took a nosedive in terms of both deal value and volume. That said, Seed and pre-Seed startups attracted the maximum number of deals.

By the same token, the jump in the deal count was largely attributed to the graduation of 15 startups from the Sanabil 500 Mena accelerator programme in Saudi Arabia.

Sector-wise, agritech came out on top for funding amount, receiving as much as 31 per cent of the funds. Fintech, HR-tech and foodtech were close behind. The three sectors combined bagged $79.5 million, translating to 64 per cent of the total amount. Of 38 deals,10 were conducted in foodtech making it the top sector in terms of deal count.

On a similar note, B2C startups collectively raised $19 million, while B2B startups secured $102 million.

Fundraising aside, a total of six acquisition and mergers (M&A) deals were drummed up in December. Fintech reported a couple of deals, while the remainder took place in healthtech, e-commerce, proptech and foodtech.

Notable transactions include Fintech Galaxy's acquisition of Underlie, Jumalty and Appetite's merger, PayTabs's acquisition of Paymes, Checkme's acquisition of DoctorOnline, Lezzoo's acquisition of Saydo and Cavendsh Maxwell's acquisition of Property Monitor.

Last month saw 22 deals attracting direct foreign investment, mostly coming from US-based investors. Regionally, it was Saudi Arabia investors who were the most active with 31 deals.

The gender funding gap continues to persist with a paltry 0.9 per cent going to female founders. Male-led startups accounted for 98 per cent of the deal value while mixed-gender teams attracted the remaining 1 per cent.

Last month, EDAM, Muqbis and Deelance did not disclose the exact amount they raised. We assigned them a conservative amount of $100,000 each.

These monthly reports are a collaboration between Wamda and Digital Digest.