The startup fighting for open finance in Mena

Mirna Sleiman is on a mission to revolutionise the Middle East’s banking and financial sector. Having spent more than eight years working as a financial reporter, she witnessed the evolution of the industry, from the dominance of legacy institutions to the rise of financial technology (fintech) startups. Amid the disruption caused by fintech, a chasm emerged between the two parties, stagnating innovation. For Sleiman, the only solution to enable the finance industry to develop was to bring the two sides together and so she launched Fintech Galaxy in 2017 to do just that.

Today, UAE-based Fintech Galaxy has developed from a networking platform connecting banks and startups to an “open finance” platform with an open application programming interface (API) infrastructure that provides integration between fintechs and financial institutions.

“The banks have been resisting change for as long as they can survive. A lot of statements were made pre-Covid about banks transforming, when Covid hit, you realised none of the banks were ready to operate remotely, let alone digitally,” she says. “We wanted to bridge the gap between financial institutions and the fintechs, that kind of collaboration is the only way banks can move into the future and keep up with the change in customer behaviour and cope with the international trends of giving customers back their own data and financial footprint.”

Historically, banks have owned customer data and according to Sleiman, did a “lousy job of coping with the sophistication of customer expectations and that’s why banks have not changed”.

In the absence of innovation among the banks, open banking platforms emerged around the world, enabling third-party developers to access the bank customer’s data related to their account and payment information to develop services like payment platforms and neobanks. Across Mena, there are only a handful of open banking platforms – Egypt-based Underlie, UAE-based UAE-based Dapi, Tarabut Gateway, which was founded in Bahrain and relocated its headquarters to Dubai, and Saudi Arabia’s Lean Technologies. The sector is still nascent but has been attracting investor interest as of late with Tarabut Gateway securing $12 million in a pre-Series A round led by Tiger Global.

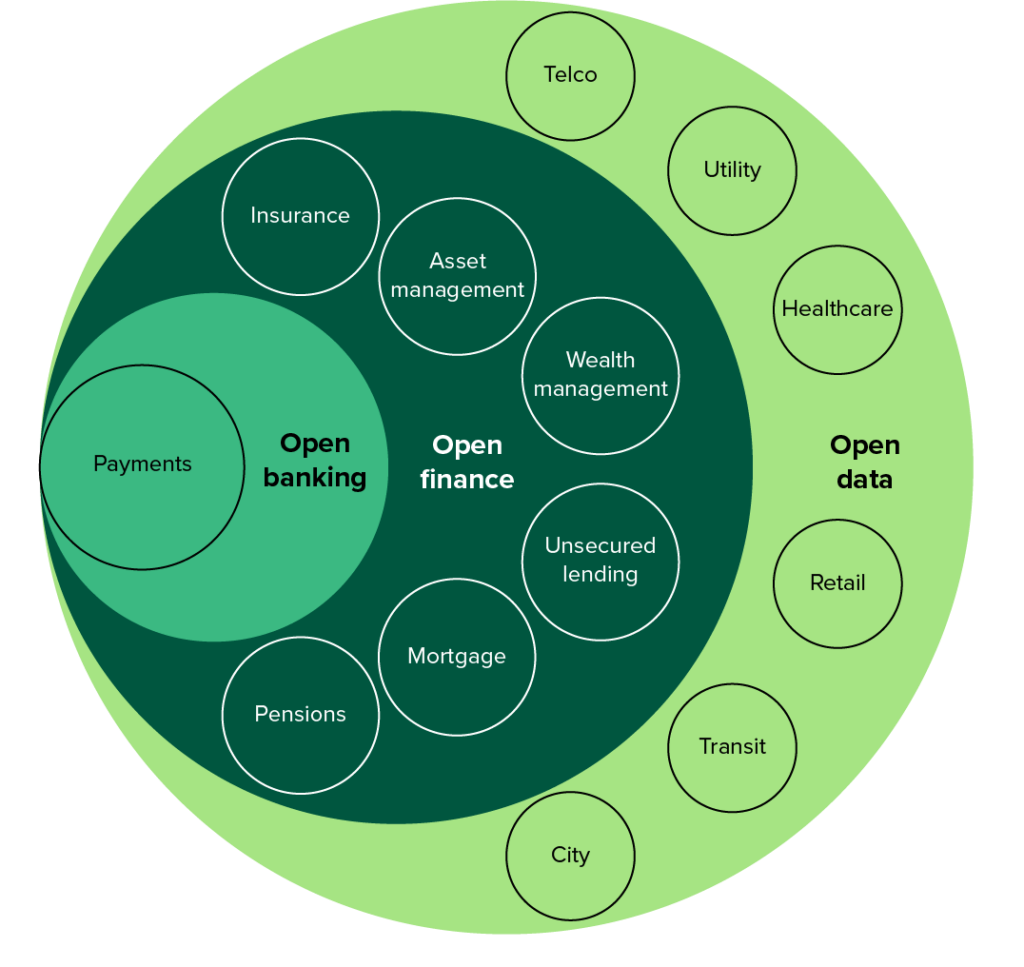

Open finance is effectively the next step in the open banking journey.

“Open banking is about payment initiation on behalf of the end consumer and account information services,” says Sleiman. “Open finance is a new use case that shows the financial footprint of a customer beyond banking.”

In open finance, financial data like mortgages, savings, pensions, insurance and consumer credit can be opened up to third party APIs. By reducing the control banks have over this type of customer data, it can encourage greater competition and innovation. Open finance, according to US research firm Forrester, is a trend towards “open data and data portability and will enable wider integration across nonfinancial industries, including sectors like healthcare, retail and government”, which will broaden the range of third parties who can intermediate financial relationships.

Fintech Galaxy’s open finance platform will provide access to customer data from partner banks through its APIs and allow developers to build new apps and services for the bank’s customers. The startup recently raised $2 million in a Seed round led by Jordan-based Ahli Bank’s fintech accelerator, Ahli Fintech to finance this.

“We are building on this platform to provide open finance services to institutions, banks, regulators, asset managers, capital markets players with innovators on the other side. Today, we have a platform that works closely with a lot of institutions in the region, in KSA, Jordan, Egypt, UAE and we have in our marketplace more than 500 fintechs – they use our sandbox, they test their prototypes and test their proof of concept. Now, we’re going to go through a live environment,” she says.

But Fintech Galaxy is facing a tough road ahead. While 80 per cent of bank executives in the Mena region believe partnerships are critical to the success of their strategies according to a recent report from Oliver Wyman, they “still fail to make partnerships work, leading to value destruction and bad partner experience”. Just 6 per cent of banks partnering with fintechs have achieved their desired return on investment according to the report.

“The majority of banking partnerships do not meet anyone’s expectations, be it the banks’ or their partners,” says Pierre Romagny, financial services partner at Oliver Wyman. “Banking industry partnerships have often been opportunistic or experimental, with banks lacking a clear framework of a two-way value creation.”

Fintech Galaxy is also the only open finance platform in the region and there are currently no open finance regulations in place. Most of the region is only just coming to terms with open banking with Bahrain currently the only country in the Middle East with a full open banking policy and framework. Saudi Arabia and Egypt are in the process of developing their own open banking regulations, while the UAE has some open finance activities in the Abu Dhabi General Market (ADGM) and Dubai Financial Services Authority (DFSA), but the country lags behind its neighbours since it effectively has four different financial regulators – the Central Bank, ADGM, DFSA and the Securities and Commodities Authority (SCA).

“The UAE is home to the largest number of fintechs in the region, but that might change and they might lose that leadership position if they don’t act fast and bring all the regulators under one umbrella,” says Sleiman. “The moment KSA has its own regulations, you will see a lot of fintechs going there. The UAE doesn’t have a choice but to move much faster.”

There are however, some indications that the sector is progressing. The pandemic was a wake up call for the banks that had hesitated to embrace technology, but there is “actual work happening on the ground” now according to Sleiman.

“There is a movement towards adopting digital innovation, we are seeing banks transforming from legacy banks to digital banks to challenger banks. This is the real shift that is happening, and the other thing happening is regulators forcing banks to transform,” she says.

According to research from US-based Consultative Group to Assist the Poor (CGAP) an extra $7 billion in revenues could be realised if financial institutions collaborated more with fintechs in the UAE, Egypt, Morocco, Tunisia, Jordan and Lebanon, while the Arab Monetary Fund has identified open banking and open finance as a powerful tool to will enable financial inclusion in a region where just 50 per cent have a bank account.

“The products and services offered to consumers will expand to anybody that has a mobile [phone]. It will increase competition in the market, reduce barriers to entry and it allows for better customer experience through faster and agile innovation,” says Sleiman.