Mena startups raised $176 million in May, lowest amount so far in 2022

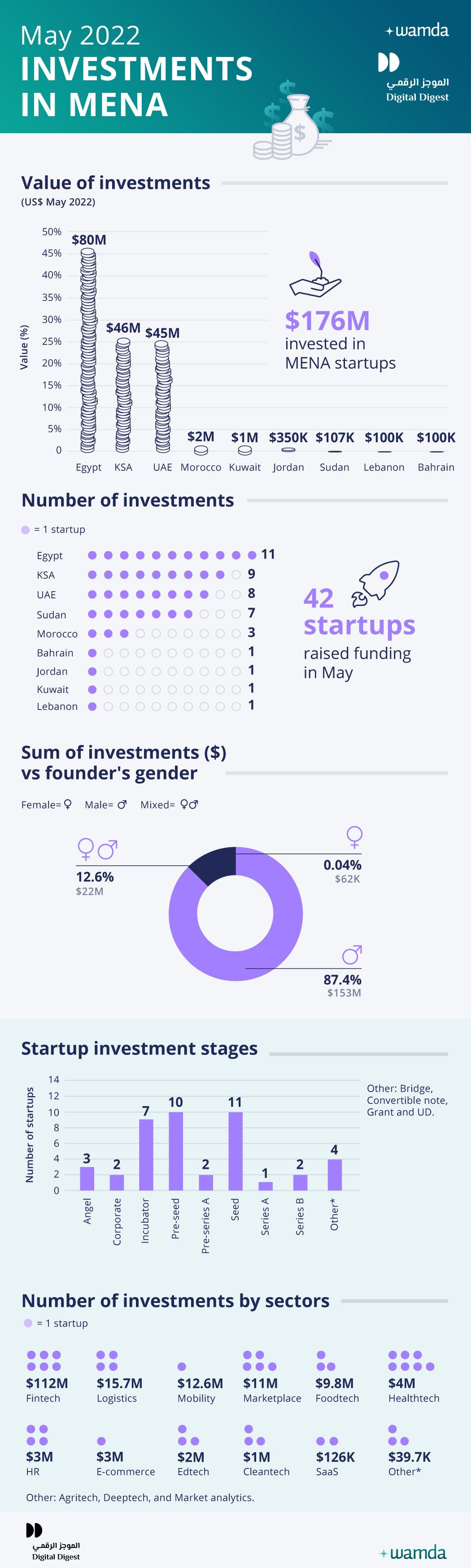

Startups in the Middle East and North Africa region (Mena) raised $176 million in May 2022 across 42 deals, a decline of 40 per cent month-on-month investment value, but a 62.7 per cent increase year-on-year.

Despite a decline in funding value, the deal count saw a 31 per cent uptick versus the previous month.

Egypt-based startups led the pack in terms of deal value and volume, raising $81 million across 11 deals, with Paymob leading the way with a $50 million Series B round from Kora Capital, PayPal Ventures, and Clay Point. The value of investments raised by Egyptian startups rose by 135 per cent year-on-year.

Saudi Arabia-based startups were a distant second with $46 million raised across nine deals thanks to fintech Hyperpay's $36.7 million round led by Mastercard, followed closely by UAE-based startups with $45 million raised across eight deals.

The total funding value was driven by the megarounds such as Paymob and Hyperpay, whose rounds combined make up almost half of the amount raised in May.

Overall, the deal volume and value at later stages witnessed a sharp fall, a sign that investors are pulling back on writing larger cheques.

That said, early-stage startups mopped up the maximum number of deals with 21 pre-Seed and Seed stage startups raising $50 million, accounting for 28 per cent of the total amount raised, a 10 per cent uptick month-on-month.

Sector-wise, fintech and marketplaces were neck and neck in terms of deal count. However, fintech bagged the most investment with $112 million, followed by marketplaces and logistics, both attracting $24 million and $15 million respectively.

The B2B software sector saw the maximum number of deals with 24 deals worth $117 million, followed by the B2C sector which attracted $57 million cutting across 17 deals.

Foreign investors participated in 21 of the funding rounds in May, with US-based investors participating in nine deals. Regionally, it was UAE-based who were the most active investors, taking part in seven deals. Sudan-based 249 Startups was the most active incubator last month, investing in seven startups.

Startups with all-male founding teams attracted $154 million across 25 deals, while startups with both male and female co-founders raised $22 million across four deals. Female-led startups collected 0.04 per cent of the total raised, amounting to $64,000 across four deals, thanks primarily to three rounds raised by solo female founders graduating from Sudan’s 249 Startups incubator programme.

Last month, seven startups did not disclose the exact amount they raised. They include Qewam, Teegara, Cloudshelf, iStoria, Natrify, Unipal, and Azom. We assigned them a conservative amount of $100,000, and a $1,000,000 for Azom, which raised an undisclosed seven-figure round.

These monthly reports are a collaboration between Wamda and Digital Digest.