Egyptian startup ecosystem faces litmus test following debit and credit card use restrictions

The Egyptian startup ecosystem is facing yet more difficulty after local banks suspended the use of debit cards outside Egypt and limited credit card use abroad to transactions worth $250 per month, as per instructions from the Central Bank of Egypt (CBE). The decision, which came into effect in early October, sent shockwaves across the entire business community, particularly startups and companies that rely on foreign software technology for their operations.

Starting 9 October, payment methods for transactions outside Egypt were limited to credit cards and cards linked to any type of foreign currency account, as per the CBE’s decision, which was made in response to the country’s shortfall of foreign currency amid a broader economic downturn.

A few days later, further restrictions on credit card use abroad were imposed, putting a cap on overseas withdrawals. The CBE said in a statement on Tuesday that the decision was prompted by some instances where credit card holders were conducting foreign transaction withdrawals without being overseas.

A lot of small businesses in the country rely heavily on debit cards to pay the bills for social media advertising accounts and software subscriptions, this is mainly due to the fact that debit cards are more widespread than credit cards in Egypt, accounting for 41 per cent per cent of the bank cards while credit card penetration stands at 8.6 per cent.

According to a paper published by Alternative Policy Solutions, a research centre affiliated with the American University in Cairo (AUC), the decision to halt debit card use outside the country “has not taken into account startups and sole proprietorships whose businesses depend on debit cards for foreign transactions”.

As soon as the news broke out, there was an outpouring of anger on social media, as many cautiously feared the possible implications.

Smaller-sized startups and businesses that have not raised funding from regional or global investors are likely to be affected the most. Those that have already raised investment from global investors are likely to be incorporated abroad with their bank accounts based outside of Egypt.

Infinity, an Egypt-based reseller of domains and hosting, which launched a couple of months ago, is among those impacted. Upon learning the news, Mohamed Elmenoufy, the founder of Infinity, says he was “devastated”.

“I just started my business, which entirely runs on cloud technology, and I have to pay for these hostings outside Egypt. All of a sudden, I can't do that. Plus, I never liked to use credit cards, especially in a high-interest environment. I personally take issues with the concept of lending. But now, I have to use one,” Elmenoufy says.

Due to the founder’s inability to pay subscription bills through his debit card, the company’s operations have temporarily been put on hold, along with its marketing campaigns.

But until he manages to apply for a credit card, Elmenoufy has resorted to one of his friends whose businesses are based outside of Egypt, to help them pay the company’s software bills. Similarly, many startup and business owners are increasingly taking to social media platforms to launch a plea for help, hoping to get in contact with those who have a bank account outside the country.

Hisham Eladawy, founder of HRtech startup Mohr, explains that his Facebook inbox was flooded with messages from people making the same request.

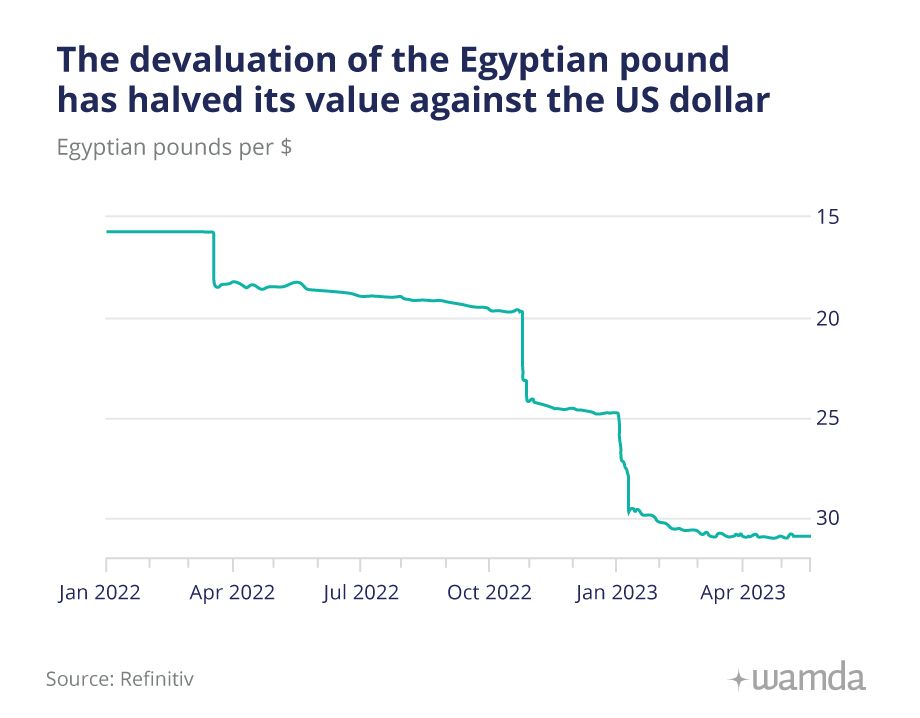

Having faced a similar situation, Eladawy recounts that he had to create a bank account in the US back in 2016 when the Egyptian pound lost nearly half of its value against the US dollar. Many believe that another round of devaluation is also expected.

“Such measures usually precede an imminent round of pound devaluation. I first-hand saw a similar scenario unfold multiple times before,” he says, adding that he currently uses his bank account in the US to pay his subscriptions.

“The situation is even more challenging for companies that have their entire clientele based in Egypt and get paid in EGP, those that have bills that they can’t pay now. I think the impact of that spills out into the wider economy.”

A moment of reckoning?

The restrictions on the use of debit cards abroad are more than likely to become short-lived. In fact, the CBE has not mentioned the duration for which the decision will last. But, the fallout of that might scare founders from venturing into entrepreneurship and may threaten the existence of incumbents.

“There are prerequisites for a startup to expand and thrive, while there are fundamental necessities for a startup to simply survive. The tools and software that we are no longer able to pay with debit cards are the building blocks of any startup. We are talking about the inability to renew domain servers and pay for web hosting,” says Salah Eldin Mohamed, CEO of Tasmimak, a SaaS platform for graphic design.

Like many other local startups, Mohamed is weighing a move overseas to keep his business afloat and avoid future threats.

“I got into a discussion with fellow founders at the onset of this crisis to see possible ways out. For many of us (startup founders), registering a company outside Egypt has not become optional; the question [is] where,” he adds.

Since late last year, droves of Egyptian startups have been leaving the country as a result of growing economic instability and steep pound devaluations in the hopes of increasing their fundraising prospects. For many, the debit card crisis has served as a final straw, nudging them to expand their business somewhere abroad as well. Given that, the overall investment sentiment in the country is likely to further weaken too.

Tarek Roshdy, an Egypt-based angel investor, argues that the current situation “drives investors to identify and adopt other non-traditional strategies and ways to continue their support to founders because what used to work in the last two years does not sound to be effective anymore”.

“I understand the motivation behind the decision and where it comes from, but I think it could have been executed in a way that ensures the collateral damage would not be that catastrophic. And we, as investors, are now required to spend more time and effort to analyse investment strategies,” he adds.

To contain the fallout from the debit card crisis, Roshdy suggests the establishment of a relief fund by concerned authorities to help startups mitigate this storm, while also stressing the importance of forging collaborations among startups.

“This calls for collective efforts; nobody can do anything alone. If we look at expansions as a quick remedy, they take so long and are costly that not everyone can afford their expenses or to have their work on hiatus for a few months until they are operationally set elsewhere. So, there’s a grey area between expanding and totally being out of business, where some sort of coordination between different businesses and stakeholders can play a huge role in cushioning the aftermath impact,” he further explains.

Temporary relief

Ever since the decision was announced, startup founders have been exploring ways to find a sustainable solution to the debit card use restrictions, with some looking to register a company or open a virtual bank account further afield.

Others are now turning to existing billing solutions offered in EGP, where they can, for example, pay social media ad accounts using a service offered by payment gateways and fintech company Fawry and prepaid card provider Meeza.

Others have introduced a billing service lately to be included as part of their offerings. Examples include Egyptian online banking startup and prepaid card provider Telda, which recently rolled out a billing service for a number of social media and streaming platforms to be paid through its app via Fawry.

Also, software development firm Extreme Solution recently developed a billing solution in EGP for Google Cloud and Google Workspace services. The company says that it is exploring working with other payment gateways, such as PayTabs and PayMob, as alternative payment methods.

The market currently boasts multiple solutions, providing temporary relief to Egyptian startups and the wider business community; however, they remain limited to a certain type of service and product and usually have a cap on the number of transactions of credit that can be tapped into, further contributing to the overall state of uncertainty faced by Egyptian startups.