From buyouts to partnerships

This article was first posted on the Coentrepreneurship platform.

More than half of all corporate-startup initiatives in MENA were launched after 2011, and 82 percent of existing corporate-venture capital (CVC) funds were established in the past six years, according to a report by Wamda and Expo 2020 Dubai.

Recently, more corporations are taking note of the importance of working with startups.

New businesses like Souq.com, Talabat.com, Fawry, Namshi and Careem, are believed to have crossed the $100 million valuation mark, and are solidifying their footprint in their respective industries.

The growth and consumer reach of such startups is propelling large corporations to launch structured Collaborative Entrepreneurship (CE) programs as a mechanism shield themselves from potential disruption in their industries.

CE’s origin story

While CE is a relatively recent phenomenon in MENA, corporations in regions such as North America have been investing in startups for decades.

Think of Intel’s venture capital fund, founded in 1991 which has deployed over $10 billion; or Qualcomm Ventures, established 16 years ago with committed capital of more than $500 million. Google Ventures is a comparatively recent fund, founded in 2009, but it has already exited five of its portfolio companies valued at $1 billion.

In the mid-60s to early-90s, the main reason for launching a CVC was making a financial return. A decade later, the dot-com era lured corporations to invest in new technology and innovation, while financial returns became the secondary motivation.

Using CE to stay alive

The highly competitive, rapidly evolving nature of the tech industry was, and remains prone to digital disruption.

In an attempt to shield themselves and stay ahead of competition, large tech companies are investing in nimbler startups, and working alongside potential disruptors to roll out products faster.

(Image via iStock)

But today CE is not limited to tech companies.

The rise of startups, which are facilitated by technology, in non-tech industries are posing a threat to large corporations. Unicorns, or startups valued at over $1 billion, are capturing market share in transportation (Uber), hospitality (Airbnb), healthcare (Intarcia Therapeutics), and finance (SoFi) industries within a relatively short time.

Partnerships instead of buyouts

Corporations in these industries are being proactive- embedding innovative technologies within their offering and exploring new partnership structures with startups - without necessarily investing in them.

Because of the bureaucratic nature and high-capital requirement of CVCs, large corporations are opting for less resource-intensive engagements they can benefit from.

New corporate-startup engagement models allow large corporations to test the waters, work closely with a large pipeline of startups, and find businesses that are on the same wavelength, all the while minimizing upfront labor and capital investment.

Different engagement models for different needs

Sponsorship of events: Corporations can sponsor entrepreneurship-related events, business plan competitions or startup-focused content as a way to integrate themselves in the ecosystem and associate their brand with startups that align with their core business or are of strategic value.

This is largely a public relations or corporate social responsibility effort.

Corporations can gain visibility in the entrepreneurship ecosystem, and expand their networks without a long-term investment. Startups can gain credibility by associating their venture with an established brand.

Some notable examples include sponsorship of Injaz by Standard Chartered, Aramex, Credit Suisse, and that of the 2016 Beirut Arabnet by Bank Audi, Beirut Digital District, and Bankmed.

Trainings and/or workshops: Corporations can offer technical and non-technical training to startups.

The most common form of this collaboration is where corporations offer training on their products and services in the hopes that startups will become customers.

Through training sessions or workshops, corporations can market their products, and potentially gain new customers. In turn, startups get access to technology and know-how.

Some notable examples are Intel’s free online training sessions for developers, and Facebook’s online training platform Blueprint and its offline workshops for MENA entrepreneurs on how to use Facebook to advertise.

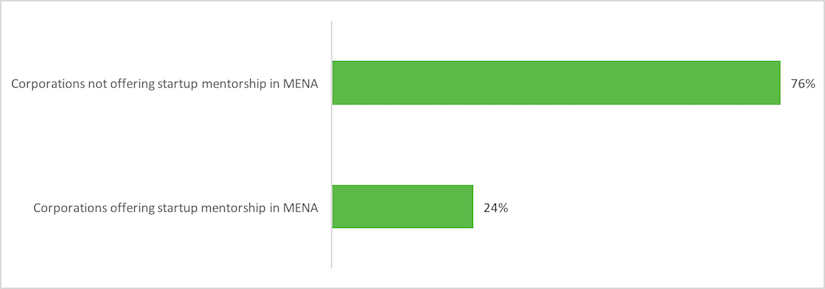

Mentorship programmes: These are a form of knowledge exchange where employees at large corporations provide their expertise to entrepreneurs on running and scaling a business. In turn, startups can offer corporations insights into new technologies and innovative business models.

In so doing, both types of businesses build relationships with potential business partners.

Corporations can assign several employees to mentor startup founders. This allows them to develop an entrepreneurship-supporting employee culture, and gives them access to new business models and products.

In turn, startups can potentially tap into the knowledge of the large corporation and establish a close relationship with an employee or an executive.

Some notable examples are GE’s Venture Sprint that it launched with Wamda, which was a six-week intensive mentorship program between GE employees and entrepreneurs from multiple industries, and Wamda’s partnership with Zain Jordan to launch Traxn, whereby Zain executives offer HR, operations, marketing and PR mentorship to five startups.

Joint go-to-market partnerships: Corporations can partner with startups and merge their offerings by co-developing a new product/service.

The most common form of this engagement is that the startup develops the new offering while the corporation offers its networks, customer base and guidance to ensure the success of the newly launched product/service.

Corporations can tap into startups’ innovation to develop competitive products/services, or venture into new markets. In turn, startups can gain access to the corporation’s customer base, gain credibility through brand association, and commercially benefit.

A notable example is GE’s Predix platform launch. The product allows entrepreneurs to design solutions for various industrial internet markets, and have the opportunity to commercialize their solutions with GE as a partner.