Can the healthtech sector maintain its momentum?

Health is typically one aspect of life that most people only consider when things go wrong, this is true on an individual level and on a governmental level, as became starkly clear when the coronavirus pandemic highlighted the underfunding of healthcare systems around the world.

As resources were redirected to deal with the rise in Covid-19 patients, doctors and hospitals had little time to deal with patients suffering from other ailments. Coupled with the lockdowns and the fear of contracting the virus in public spaces, the only viable solution was virtual healthcare. Telemedicine, virtual consultations and e-pharmacies have gained popularity over this past year and are becoming an increasingly important pillar of the global healthcare system.

Analysis prior to the pandemic suggested that the use of technology in healthcare plays a big role in increasing efficiency and improving infrastructures of health systems under increased pressure, something that became visible during the pandemic.

According to the 2020 Global Ventures Digital Health report, the remote healthcare market in the Middle East and North Africa (Mena) was valued at $989 million in 2019, and was projected to reach $1.8 billion in 2024, growing at a CAGR of 12.8 per cent.

With approximately 400 million people in pandemic-hit Mena lacking access to essential medical services, health technology (healthtech) solutions rose to shed the burden off traditional healthcare systems.

vHealth, a UAE-based telehealth provider, saw a 500 per cent increase in the usage of its app between March and September 2020. Digital health platform Altibbi needed three years to build a patient base of one million, while in 2020 alone it attracted two million consultations.

The pandemic enabled healthtech to thrive, but the long-term trajectory remains a topic of debate.

A McKinsey 2020 Virtual Health Survey indicates that healthcare providers still feel hesitant towards virtual healthcare solutions, raising concerns about security, profitability and workflow integration compared to in-person services.

“Teleconsultation went massively up during Covid, but with ease of restrictions it went down again. Not because patients are not using it, but because healthcare providers do not have the time to do it. They still prioritise walk-in appointments, as the mindset is that walk-ins give them more money,” says Rafiq Shabib, finance director at digital health platform Healthigo, which connects patients with doctors, insurance providers and pharmacies.

Additionally, there is a gap between consumer interest and usage. The report shows patient interest in telehealth was 76 per cent while their actual usage was 46 per cent. Lack of awareness of healthtech services, education on types of care that could be met virtually and understanding of insurance coverage are some of the factors causing this gap.

“Telemedicine is a relatively new concept to the local market, and initially there were some concerns over reliability and data privacy. However, the unprecedented surge in usage is helping consumers overcome their reservations, as they are actually trying the products and finding them to be safe and convenient. Necessity has also significantly boosted awareness around the technology, not just for consumers but also investors,” say Dr. Mohamed AlGassab, operations director at Cura, a Saudi Arabia-based telehealth provider.

Culture has also proven to be one of the biggest hurdles to digital transformation in healthcare. While some patients are becoming more comfortable with adopting the digital health solutions, doctors are still hesitant. Dr Imran Haq, a UK-based oculoplastic surgeon and founder of Sonzaikan, an AI-driven compact device with remote diagnostic software, was taught in medical school back in 2009 that video consultations are unacceptable due to lack of human interaction

“There needs to be an understanding that this is the change,” he says. “For our generation, no one is embarrassed to send a photo or a selfie. This is just the way we live. Doctors need to realise [healthtech solutions] are complimentary, they do not threaten their own practice. The current hierarchy need to be disbanded,” he says.

Investment in healthtech

Similar to other sectors that suffered economically in 2020, healthcare providers faced significant pressures to cut costs and optimise operations to meet new types of demand. As such, companies with solutions that increase operational efficiency have seen heightened investor interest.

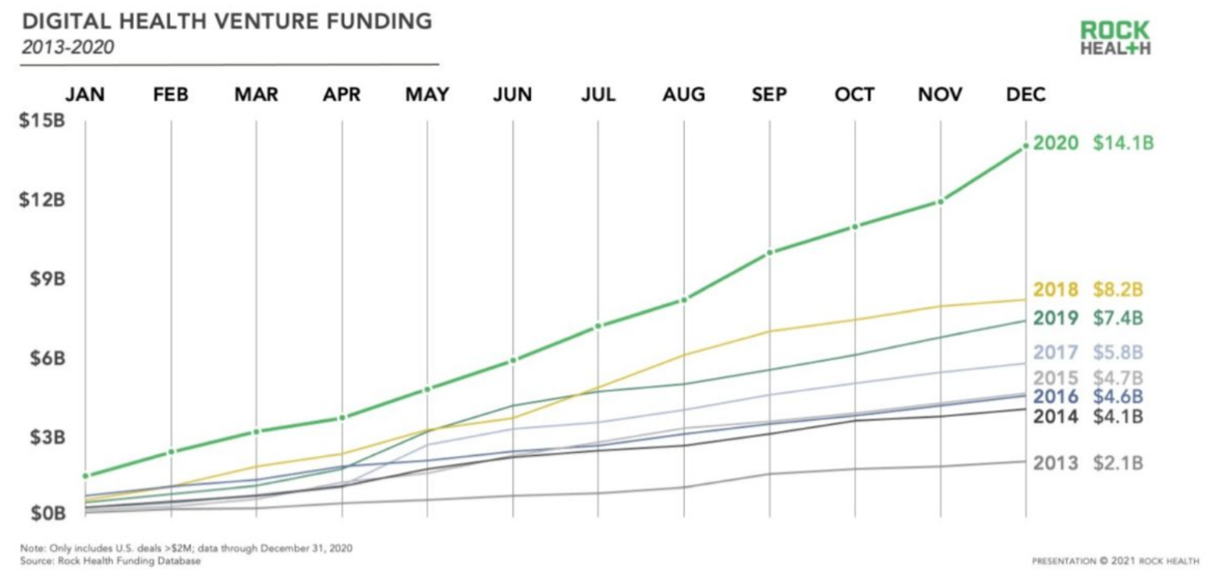

Rock Health Funding reported that healthtech startups globally raised $14.1 billion last year almost double the 2019 figure of $7.4 billion.

In Mena, Magnitt’s ‘2021 Emerging Venture Markets’ report showed the year-on-year investment in healthcare startups more than tripled in 2020, increasing by 280 per cent to $72 million. However, healthcare funding only accounted for about 7 per cent of total investment funding in Mena in 2020, according to Marcel Muenster, founder and CEO of The Gritti Fund, which eyes pre-Seed startups in healthcare among other sectors.

“Sixty-nine per cent invested in healthcare in 2020 [in Mena] were allocated to two startups only, so while the healthcare funding has tripled from FY19 to FY20, the number of deals has decreased by 10 per cent,” says Muenster.

The investment trend in 2020 seemed to be doubling down on telemedicine, hence the big-ticket investments in Egypt-based Vezeeta and UAE-based Okadoc, which are “likely a direct result of Covid-19 and its impact on the access to healthcare and capacity constraints”, according to Muenster.

“I’d have expected to see a different uptake of digital health solutions by investors and its implementation. But there are simply not enough investable healthtech startups in Mena, most entrepreneurs will be opportunistic and choose an industry that is better funded, and more likely to attract an investment, and healthcare is still a highly regulated space, which could deter many entrepreneurs. [There is also] lack of experienced healthcare investors that can help startups to navigate the complex ecosystem,” he adds.

When the pandemic hit, investment strategies were impacted and investors focused their funds on existing investments while adopting a wait and see approach for new deals. Investment deals in Mena were down 7 per cent year-on-year with startups raising $654 million across 363 deals in 2020, of which almost half was raised in the first quarter, before the virus reached the region.

“VCs and investors became hesitant, they wanted to double down on their existing investments. But the current investments are already out of date. We are agile, flexible and have industry experience. We are making changes from the frontline issues we can see, VCs and angel investors need to understand this. They need to look at new models that are sustainable. You do not want an Uber or a WeWork where you are funding massive growth with no profit. This old capitalism is gone now,” says Haq.

New way of thinking

Hospitals and the healthcare they provide are being reimagined, with greater solutions now available on digital devices.

“When airports came about they were made like train stations, because nobody understood the paradigm shift. It is the same with hospitals today. We did not think of hospitals as dealing with infectious diseases, as a result they are made like offices. This is now changing, you look in China and in the UK, hospitals are built in 10 days to be vast open spaces with negative pressure to minimise the spread of any infectious disease. Hospitals are now rethinking their plans, normal outpatient care do not need to be seen in hospitals,” says Haq.

This past year has transformed and innovated the healthcare industry at large, with increased focus on healthcare consumerism. A Deloitte study suggests that in 2021 investors will likely be looking closely at technology companies that are able to combine virtual care with a retail experience.

Such a hybrid model might allow consumers to access primary care, behavioural health or specialty care through a combination of virtual health and in-person visits at a retail location.

“We are one of the few companies that is patient-led, not insurance-led. This is related to our region, 60 per cent of healthcare expenses here are out of pocket expenditures, not insured. It was always more consumerised as opposed to other parts of the world,” says Jalil Allabadi, founder of Jordan-based telehealth platform Altibbi.

Armed with greater access to knowledge and wearable devices, patients are beginning to take control of their own health. Demands for personalised care services built on two-way conversations with doctors have surfaced, moving way from the traditional model of accepting medical advice without participating in the process of diagnosis and treatment decisions.

“One of the main things Covid highlighted was how much information is available on the internet. The right way is for patients to come with information to their doctor, with opinions about their own care. It is their own body after all. The way that “doctors know best” in a hospital environment is not the future, the sooner doctors realise this, the better it is for patients,” says Haq.

Deloitte’s Center for Health Solutions survey found that 51 per cent of patients are likely to push back on recommendations from a clinician if they disagree, especially when they are equipped with more information about their health and conditions.

“We are in an era of personalisation, every online user has a different experience based on their data and preferences. For healthcare, it is about the outcome of the experience. We are now seeing the evolution of genomic science, where based on your DNA and genome, the treatment and medications will be completely personalised to you,” says Fodhil Benturquia, CEO and cofounder of Okadoc, a UAE-based doctor booking platform.

“There is also vitamin personalisation, companies analyse your blood test to see what you are lacking, you then receive a pack – or even a single pill – to give you vitamins that match your deficiency. This is where healthcare is at today.”

As digital healthcare continues to develop, regulators will need to respond rapidly with policies to help drive its growth and protect consumers and patients.

“A lot of things will drive digital health adoption, one of the big ones will be regulation. The more governments pay attention and drive regulation in the right way, digital health will be mainstream. Digital health is no longer separated than traditional health. In a couple of years we will stop saying digital health as a separate thing,” says Allabadi.

What next?

The pandemic has changed long-held perceptions about the nature of care and care delivery. Healthcare is likely to revolve around sustaining wellbeing rather than reacting to illness.

“The paradigm is changing from treating diseases to treating health. The emphasis became on the patient’s health, and when patients are involved in this process, trust will be there,” says Haq.

Healthcare providers are starting to consider such trends as they plan for the future, as innovators in the space are developing capabilities, products and services that will likely be critical to the future of health.

According to Muenster, Covid-19 is “here to stay” so healthech startups will have to adapt to the changing demands of healthcare from offering different specialities on telemedicine to addressing mental healthcare for personal and professional struggles related to the pandemic.

“I foresee a significant increase in enterprise buyers of digital health solutions. One simple reason is that those employers unable to switch to 100 per cent remote work like tech companies Google, Facebook, etc., will have to provide additional health and safety solutions to their employees. Digital health is perfectly equipped for that necessary transition and adoption of advanced safety measures,” he says.

But while demand will continue to increase for digital healthcare solutions, particularly those that offer a personalised solution, Muenster is pessimistic when it comes to investment in healthcare.

“The pandemic has unveiled the pain points of insufficient healthcare systems. Hence, investors flooded money into a variety of healthtech sectors that were obvious and blessed with explosive growth. Now, while it seems obvious to assume that this trend continues I personally don’t think it will,” he says.