Numa: bridging the fintech gap for freelancers

Any company familiar with freelancers in the Arab world will know how difficult it can be to pay them. Many remain unbanked and still opt for remittance services like Western Union. Those who do have bank accounts, will usually have a personal checking account with no option to separate their work-related transactions.

Freelancers and micro businesses, those that employ two to three people, have been left without a viable solution when it comes to financial and banking services. They are effectively too small for company accounts and too big to rely solely on personal accounts.

It is a gap that Jordan-based Numa is hoping to fill with its all in one platform for freelance workers in the Arab world. Founded earlier this year by Loay Malahmeh and CTO Issam Najm, Numa is a fintech platform that sits on an existing bank’s infrastructure. It offers a digital bank account with virtual IBAN and a virtual prepaid card, making it easier for freelancers to get paid and make transactions.

Over the past couple of years there has been a spate of freelance job sites in the region, some offering jobs in niche sectors, others taking a more general approach. Websites like Mostaql.com and elharefa offer a platform for freelancers to pitch and apply for projects alongside global platforms like Upwork. But while the hiring side of things is well catered for, the financial side is not.

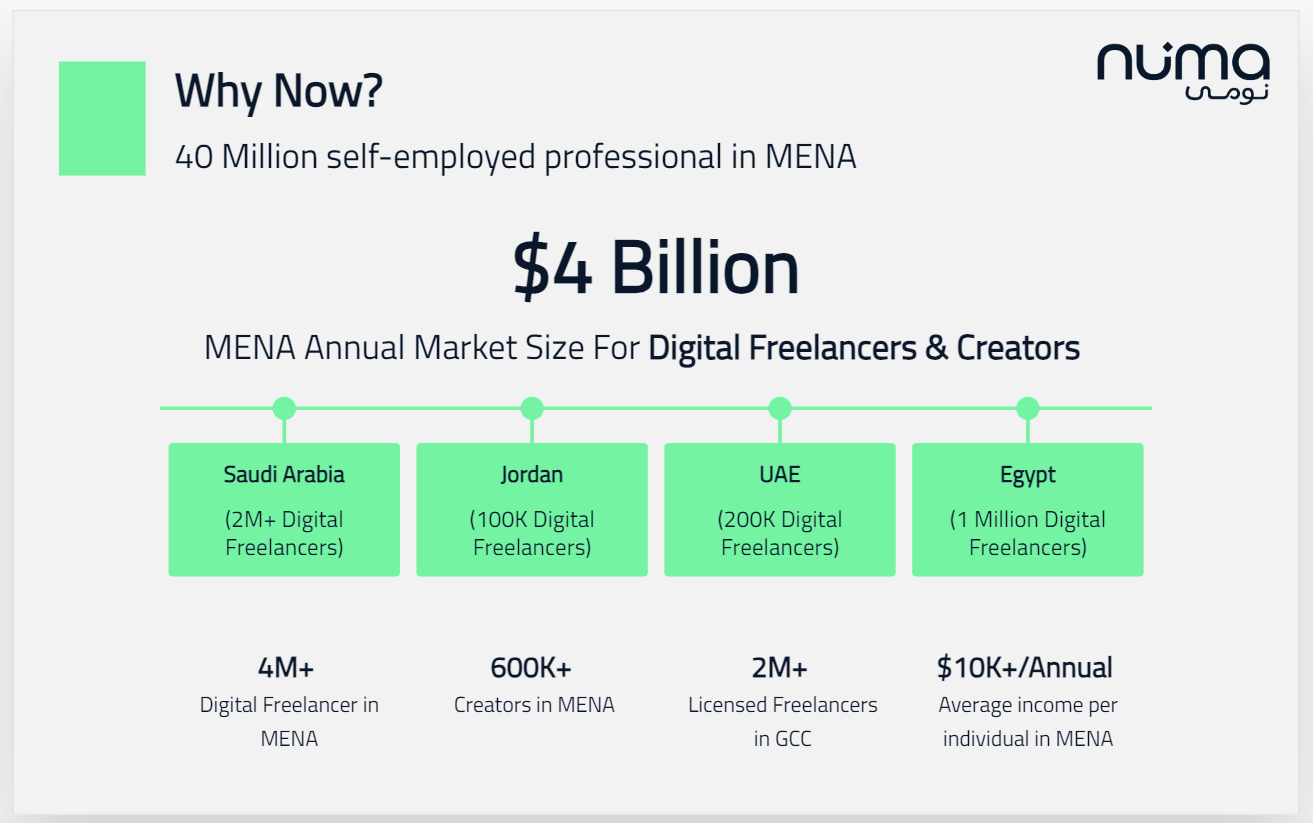

According to the International Labour Organisation (ILO), there are more than 40 million self-employed workers in the Middle East and North Africa (Mena). Numa estimates based on its own data that of these, four million are digital freelancers and creators with an average salary of $10,000, making it a $4 billion market.

“Today as a freelancer, when you go to the bank, you’re faced with two inconvenient options - one is a consumer bank account, which is not enough, as it is just a card and an account and the other option is business banking, which is too complicated and requires a lot of paperwork,” says Malahmeh.

Numa fills the gap in between consumer and business banking without the need for extensive paperwork and licences.

“As a freelancer, your needs are more related to a micro business, it’s not just about having a bank account or card, it’s more about access to finance and getting business tools for tax and admin,” adds Malahmeh.

Financial services are currently built and designed to service the traditional economy and business argues Malahmeh, which denies freelancers access to credit lines, and other financing tools as well as medical insurance. Numa’s solution offers not only the banking services and a virtual prepaid card, it also offers other financial services like contract invoicing, helping with tax returns and expenses management. It is also developing a credit scoring system that accommodates the complex income patterns of freelancers, laying the groundwork for future lending products for this overlooked segment.

Numa will be partnering with banks to provide the banking services. It recently launched its platform in private beta testing, amassing customers like software developers, creative designers, digital marketers, and solo entrepreneurs across various fields in Jordan, after raising a pre-Seed funding round from investors including BLDR Ventures and Oasis500.

The startup is currently looking to raise a Seed round to enable its expansion plans to Saudi Arabia and the rest of the GCC.

“The opportunity is massive in Saudi Arabia because the GCC already has a licence for freelancers. There are more than two million people in Saudi Arabia who have a freelancer licence,” says Malahmeh.

But scaling across the region will not be so easy as Numa is not a bank and does not have a banking licence. Instead it is a financial technology (fintech) company and partners with banks to offer its services.

“All of our banking services are provided by our banking partners,” says Malahmeh. It is the bank that does the KYC, issues the virtual prepaid cards and IBAN, but this is all presented with Numa’s branding.

To scale beyond Jordan, Numa will have to find a banking partner in each country and in countries without open banking regulation, this will be difficult.

“The challenging part is that each region has its own rules of open banking and even the open banking regulations in one country is different to another, so I can’t take the same infrastructure I’ve built in Jordan and take it to the GCC today,” explains Malahmeh. “When it comes to acquiring new users in another country in the region, it is as if you’re opening an office in France, and then you want to go to Brazil for example.

“It takes so much time to understand regulations and there’s no clear blueprint of how to do it from one country to another. There are no shortcuts in fintech, you have to follow the rules and regulations. So this is a major challenge in our region because it is fragmented,” he adds.

One way to circumvent this would be to partner with an open banking platform like Lean Technologies or Tarabut Gateway to enable anyone with a bank account to access Numa’s services, while the cards could be issued through a partnership with Visa or MasterCard.

“In the GCC it’s about having the right partner, the right open banking technology and having a bank for other services that includes financing and credit,” says Malahmeh.

Numa is currently free for users, and will apply a freemium model as part of its monetisation policy.

“We’ve deliberately made the app free because we want to study user behaviour, so today users can come and experience the app and the services which will later be available through a subscription model. The second revenue stream that we want to introduce later on is from access to finance so providing credit lines, which we will do with third parties,” says Malahmeh.