Family offices a new addition to investment landscape

Family offices are the new breed of investor in the MENA tech sector, according to Beco Capital.

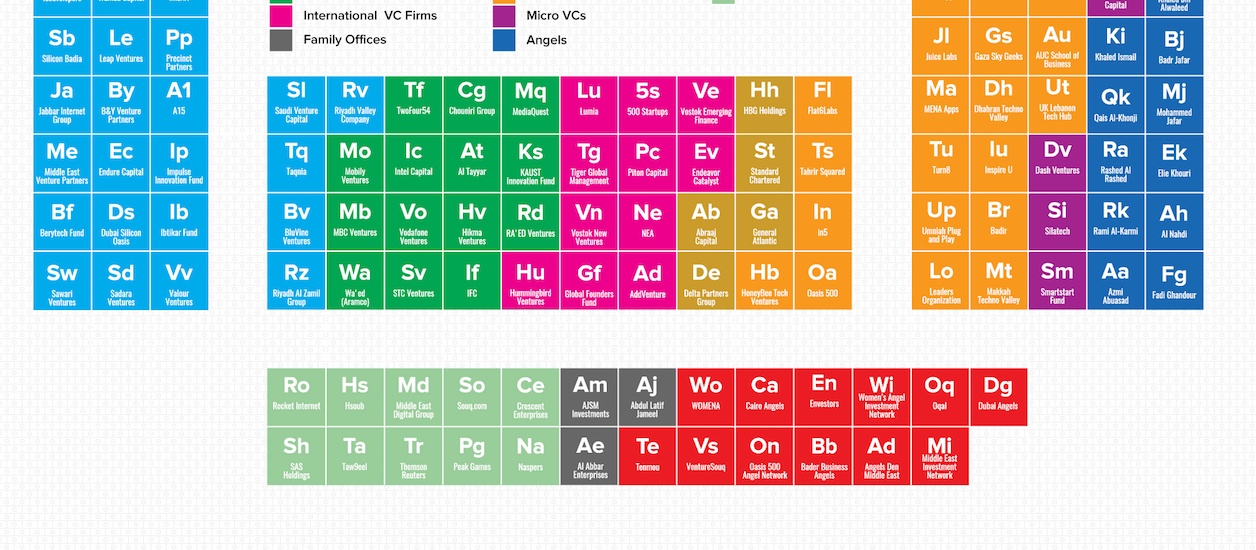

The UAE-based investment firm, has released an update of their 2015 periodic table of MENA investors and added the new classification of ‘family office’.

The definition, according to Beco Capital, is a “family-controlled investment groups based in MENA, investing or intending to invest in MENA, active in the last 12 months”. These include UAE-based AJSM Investments; Saudi- and UAE-based Abdul Latif Jameel and UAE-based family firm Al Abbar Enterprises.

Since their creation four years ago the five-sibling-strong AJSM Investments has invested in Idea Prodigies, a software development firm, and according to Entrepreneur magazine they are to start an initiative called AJSM Hero “to help nurture new businesses in the UAE”. Al Abbar Enterprises, a parent company for various retail and food and beverage franchises in the Middle East and Asia, have been steadily building up their ecommerce portfolio.

BECO has also included ‘international VCs’. These include Tiger Global Management, Lumia and Vostok New Ventures.

The 2016 edition of the ‘Periodic Table of Tech in Mena’ is a comprehensive outline of the “key players” in tech investing and mergers and acquisitions in the region.

New country additions to their layout of investors are Saudi Arabia and Palestine, while Iran and Turkey are still not featured.

“Last year’s acquisitions were part of a wave, but this year the growth is of a different nature as startups look to expanding into new and neighboring markets,” said Beco Capital CEO Dany Farha in a statement. “This reduction is counterbalanced by the introduction of family offices, who as we see it, are now participating as strategic investors.”

Other key differences in the updated include, 25 MENA-based VCs (compared with 15 last year) and their new additions include Lebanon’s B&Y Venture Partners (formerly Y Venture Partners), Palestine’s Ibtikar Fund and Saudi Arabia’s Taqnia Fund.

According to the updated table there are 115 private investors in the VC sector, compared to the 92 present in last year’s table; incubators/accelerators have nearly doubled since they last published, to 20; and ‘tech acquirers’, corporations in the tech sector acquiring startups on a regular basis, “active in the last 12 months” are now at 10, when previously 17. However, missing from the table was newly launched Algebra Capital, from the guys that brought us Ideavelopers, andEgyptian fund Menagurus. Earlier this year Menagurus created a fund of over $12 million for investing in early stage startups, while Algebra Capital is looking to raise another $10 million after getting $10 million already from the Egyptian-American Enterprise Fund (EAEF).

“With 115 players currently investing in the technology startup sector across its various stages, from incubation to angel investments all the way to providing VC growth and late stage capital, we still believe that the market will trend to consolidation,” said Farha in the statement.

According to the CEO the scene was likely to “shake out the weakest links” and a see a reduction in the number of players over time.

“For the rest, they will be riding an ascending trend supported by their sound investments in growing tech companies, their existing dry powder and exits. More money will flow to fewer top performing VC investors and ecosystem builders over time as capital allocation pursues the best performance,” he continued.