MarkaVIP launches new platform, mobile apps, hints at new verticals to come

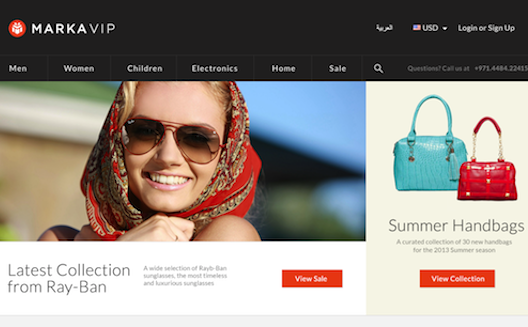

MarkaVIP, a leading regional flash sales site, has announced the launch of its new iOS and Android mobile applications, also debuting a sleek new web interface, new logo, and new recommendation algorithms yesterday.

Everything about the new platform is data-driven, says founder and CEO Ahmad Alkhatib. “We’ve taken into account two years of historical information, including customer surveys, information from analytics on where customers are abandoning carts, and we've delivered this platform tailored to what customers want. The position of the buttons, the navigation menu, the colors- everything has been decided on based on intelligence and data.”

Aside from a soothing, minimalist look featuring large, glossy photos, which looks a lot like U.S. flash sales site Gilt Groupe, the site has also noticeably adopted orange as its new color- a shade Henri Asseily, the founder of Shopzilla, once revealed was best for enticing buyers to make purchases.

MarkaVIP’s orange revamp couldn’t come at a better time. With home décor juggernaut Fab firing employees and pivoting away from flash sales, the viability of the model has been called into question. Yet, other sites are proving that now is the time to strike; Zulily has filed for an IPO, and Gilt Groupe, after a year of restructuring, may follow.

MarkaVIP is also at a critical juncture. Its biggest competitor, Souq.com, raised around $40 million from Nasper’s last year. Namshi, its other major competitor, has raised $34 million; both are building quickly. To date, MarkaVIP has only raised $18 million.

Externally, MarkaVIP has a healthy 3 million members, 60% of which make repeat purchases (for comparison, Gilt Groupe, which is valued at $1 billion, had 8 million members at the beginning of the year). Yet it’s been dogged by rumors of a less-than-meritocratic internal culture. Should MarkaVIP stumble, it could bring an ecosystem of smaller companies down with it.

Fortunately, the company seems to be ushering in a new era. Here are a few of the changes taking place:

Internal culture

Alkhatib is clearing up the rumors- and Marka’s culture. ”We've created a new system,” he explains. “We’re merciless when it comes to delivering on initiatives and existing within a high intensity environment. If we detect within the first three hours that someone doesn't live up to our standards, then they're gone. It’s very similar to a Silicon Valley culture.”

The average age is 26, he says. “It’s a very young, very passionate team, very open, and very respectful.” Although the majority of the company’s employees are in Jordan, its team is a melting pot- “we’ve hired ex-Amazon people from Spain, ex-Zalando from Germany; we’re hiring from the UK, the Valley.”

Over 95% of those who have left recently were terminated, says Alkhatib, one exception being COO Sohrab Jahanbani, whose departure was amicable. "Sohrab came in at a critical point when MarkaVIP was restructuring and going through an upscaling initiative, and he delivered on all of his initiatives,” he explains. “Sohrab is also an entrepreneur, and he has his own ideas and own projects, and the projects he took on at MarkaVIP were completed. It was a very graceful disconnect, and he continues to take an advisory role at MarkaVIP."

Mobile and personalization

Aside from its internal changes, Marka’s facelift and new apps should boost its transactions on mobile, which currently accounts for over 41% of its traffic (a percentage on par with Gilt, whose founder Alexis Maybank predicted in a video chat with Wamda last year that the company could be a "mobile majority" business by 2014).

Personalization will also be a large focus. Part of what made Gilt and Fab so exciting following Amazon, was their focus on personalized interfaces and e-mail shots that made it fun for buyers to browse through beautiful things, Erin Griffith at PandoDaily argues. Amazon may be larger than the top 12 global retailers combined, but it’s not particularly fun to browse. Like its competitors, MarkaVIP will now be doubling down on personalization in both its apps and its newsletters to entice customers.

New verticals

When it comes to profitability, Alkhatib says that MarkaVIP has “made the math work to be able to have a profitable and sustainable business.” Translation (mine, not his): it’s likely not profitable now, but hopes to be with the addition of new verticals. (When asked whether the company is focusing more on growth or more on profitability, Alkhatib says, “both.”)

For one, MarkaVIP is clearly adding cars as a vertical. The new site features an ad for a Toyota 86 that will sell for $1 to the customer who purchases over US $100 with their credit card during November and then, on December 1st at 10am, is the first to click the checkout button to buy the car. (When asked to confirm that auto is a new segment, Alkhatib says playfully, "I don't know.")

The deal is also a clear play to boost credit card use in a market where cash-on-delivery dominates. To minimize the cost of COD, MarkaVIP is now delivering over 50% of its orders using its own last mile delivery system, while betting on unique deals with PayPal and Visa to boost credit card use. Turning off payment gateways and going COD-only, which rival Sukar has done, is a “huge mistake,” says Alkhatib.

A full sale segment?

Given general trends away from discounted deals and towards full sale online retail, it’s also likely that MarkaVIP will open a full sale segment. Alkhatib wouldn’t comment on this possibility, but didn’t deny it.

It’s a risky move; both Gilt Groupe and BeachMint have seen the dangers of growing too quickly. But although Marka’s margins are, as Alkhatib says, “healthy,” it could allow for better margins and more inventory in the longer term. To compete with others in the online retail space, however, the company would likely need to raise more investment.

For now, MarkaVIP is focusing on its core business, helping customers not to hunt for discounts on luxury goods, but to “make intelligent decision[s] to buy them for less,” Alkhatib says. If it can make a good name for flash sales in the Middle East, it will help regional growth and keep global firms interested in the Arab region.